President Donald Trump has hailed tariffs as “a very beautiful thing” even as global markets spiral into chaos following his seismic “Liberation Day” announcement, deepening an economic crisis that has wiped out trillions in value.

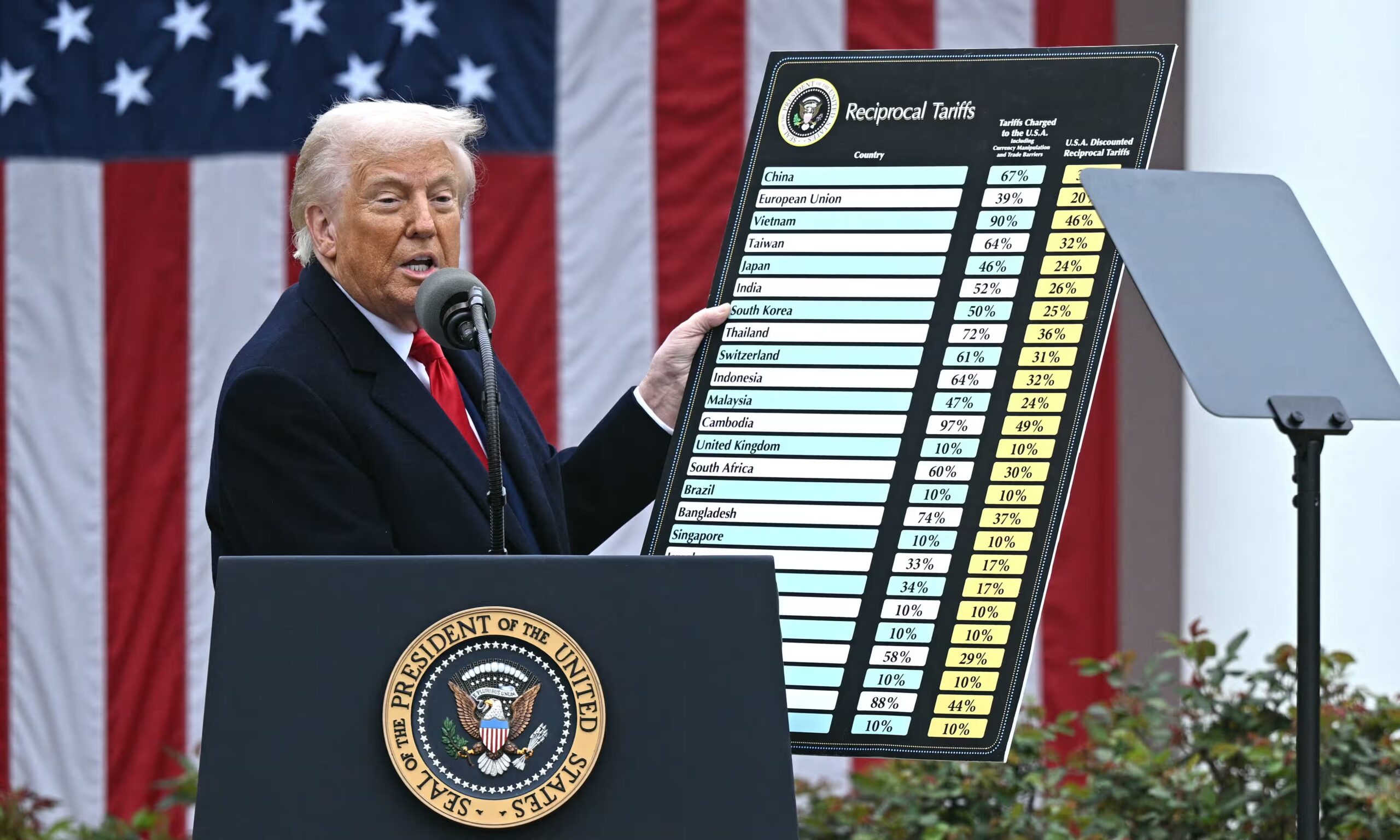

Unveiled on April 2, the sweeping tariff regime—imposing a baseline 10% duty on all imports and higher rates on key trading partners—has triggered a relentless sell-off, with U.S. stock futures plunging and Asian markets recording their worst drops in years.

Trump, undeterred by the collapse, insists the measures are a vital cure for trade imbalances, a stance that has fueled both fierce backlash and retaliatory actions from nations like China. As investors flee and businesses brace for fallout, the world watches a high-stakes gamble unfold.

The market tailspin intensified on April 7, 2025, as Asian exchanges opened to staggering losses, amplifying a brutal week that saw the S&P 500 shed over 10% and the Nasdaq enter bear market territory.

Speaking aboard Air Force One late Sunday, Trump brushed off the carnage, arguing that “sometimes you have to take medicine to fix something” and touting tariffs as a revenue windfall already pouring “tens of billions” into U.S. coffers. His remarks came hours after U.S. stock futures plummeted—S&P 500 futures down 4.3%, Nasdaq futures off 4.7%—signaling another punishing day ahead. The “Liberation Day” shock, as it’s been dubbed, has morphed from a policy flex into a global economic tremor.

The ‘Liberation Day’ Bombshell

Trump’s tariff rollout, announced in a triumphant Rose Garden speech, promised to “liberate” America from unfair trade practices. The plan slapped a 10% duty on virtually all imports, with steeper levies—up to 46% on Vietnam and 34% on China—targeting nations with large U.S. trade surpluses. Treasury Secretary Scott Bessent framed it as a negotiation tactic, claiming over 50 countries had initiated talks by Sunday. Yet the immediate impact was chaos: Japan’s Nikkei 225 cratered 8.9%, Hong Kong’s Hang Seng fell 10.37%, and Taiwan’s Taiex triggered circuit breakers with a 9.7% drop, hammering tech giants like TSMC.

The administration’s rhetoric has leaned hard into optimism. Trade adviser Peter Navarro told Fox News the tariffs would force “zero-tariff” offers from trading partners, predicting a market rebound once deals materialize. Trump echoed this on Truth Social, calling the policy “a beautiful thing to behold” and blaming past leaders like “Sleepy Joe Biden” for ballooning deficits. Critics, however, see echoes of the 1930 Smoot-Hawley Tariff Act, warning of a self-inflicted wound that could spiral into a global recession.

Markets in Free Fall: Asia and Beyond

Asia bore the brunt of the initial shockwave. Hong Kong’s market, a regional bellwether, saw its worst day since the 2008 financial crisis, with losses spanning tech, finance, and consumer goods. Japan’s banking sector plunged over 12%, while South Korea’s KOSPI and Australia’s ASX 200 dropped 5% and 6.3%, respectively. China’s CSI 300 fell 6.31%, dragging the yuan to its lowest since January as Beijing retaliated with 34% tariffs on U.S. goods. Oil prices sank 3% Monday after a 7% Friday tumble, reflecting fears of a demand collapse.

The U.S. wasn’t spared. Wall Street’s late-week rout saw the Dow plummet 2,231 points Friday—a 5.5% loss—while the Nasdaq shed over 20% from its December peak. Sunday’s futures collapse underscored the panic, with investors piling into bonds and driving yields down. “This is a market screaming for Trump to reconsider,” one analyst told CNN, pointing to the $5 trillion erased from U.S. equities in two days. The global contagion has left no corner untouched, with even smaller markets like New Zealand’s NZX 50 down 3.5%.

Trump Calls Tariffs ‘A Very Beautiful Thing’ as Markets Continue Collapse

Unfazed by the wreckage, Trump has doubled down. “The tariffs give us great power to negotiate—they always have,” he told reporters Thursday, a refrain he repeated Sunday as markets bled. He framed the policy as a long-overdue fix, claiming it’s already yielding results—Vietnam’s offer to scrap U.S. tariffs being a prime example. On Fox News, Navarro dismissed the sell-off as short-term noise, urging investors to “sit tight” for a historic boom. Trump even suggested the market dip was a buying opportunity, a sentiment at odds with Wall Street’s gloom.

The administration’s bravado has drawn sharp rebukes. Hedge fund titan Bill Ackman, once a Trump booster, warned of an “economic nuclear winter” on X, urging a pause. NBC interviewed retirees watching their 401(k)s shrink, one lamenting, “This isn’t beautiful—it’s terrifying.” Economists like Oxford Economics’ Ryan Sweet predict a GDP hit, with inflation and layoffs looming if the tariffs persist. Yet Trump’s inner circle remains defiant, with Bessent telling NBC’s “Meet the Press” that losses are overstated amid “record volume.”

Global Retaliation Ramps Up

The tariffs have sparked a cascade of counter-measures. China’s 34% duties on U.S. goods, effective April 10, jolted oil and commodity markets, amplifying fears of a trade war spiral. The European Union is weighing targeted reprisals—possibly hitting Tesla—while the UK’s Keir Starmer vowed to “shelter” businesses, hinting at tax relief. Canada and Mexico, facing a 10% baseline plus a 25% auto tariff, are in talks but haven’t ruled out retaliation, despite USMCA protections. Smaller nations like Thailand (36% tariff) and Israel (17%) are also scrambling to negotiate.

China’s response has been the most aggressive, with state media blasting Trump’s “weaponized levies.” The International Monetary Fund warned of a global recession if the standoff drags on, a view echoed by the BBC’s coverage of UK pensioner woes. Protests erupted in U.S. cities, with critics linking the tariffs to Trump’s broader cuts in federal programs, branding it a “power grab” that punishes the vulnerable. The global backlash has only hardened Trump’s resolve, with him quipping Sunday, “China’s been hit harder—not even close.”

The Human and Economic Toll

Beyond the headlines, the tariffs’ real-world bite is emerging. U.S. consumers face price hikes, with some stockpiling goods before costs soar—Walmart reported a 15% sales spike last week. Businesses are reeling: Jaguar Land Rover paused U.S. shipments, while farmers fear another export hit, though Agriculture Secretary Brooke Rollins hinted at aid. Retirees like Paula, interviewed by NBC, voiced despair as nest eggs dwindle, asking, “How do we survive this medicine?”

In Asia, supply chain linchpins like TSMC face existential risks, threatening global tech production. Vietnam’s footwear sector, a U.S. export powerhouse, teeters as Hanoi scrambles for a deal. The human cost is visceral—shoppers, workers, and investors alike grapple with a policy Trump calls “beautiful” but many see as brutal. “This isn’t a negotiation—it’s a sledgehammer,” one economist told CNN.

A Fork in the Road

As markets brace for another volatile week, the administration faces mounting pressure. The Federal Reserve may cut rates by May if recession signals intensify, while Asian regulators—like Japan’s central bank—eye currency interventions as the yen surges. Trump’s team insists the pain is temporary, with Navarro predicting a “massive turnaround” once trade deals lock in. Bessent cited Vietnam’s overture as proof, though no firm agreements have surfaced.

Critics see a different path. Democrats mocked Trump golfing in Florida Sunday, with Senator Adam Schiff calling it his presidency’s “enduring image.” The New York Times reported pre-announcement dissent among advisers, some urging moderation he ignored. Whether this yields a rebalanced trade order or a prolonged slump hinges on Trump’s next move—and the world’s response. For now, his “beautiful thing” is a bitter pill, with no clear cure in sight.

Focus Keywords: Trump tariffs beautiful thing, markets collapse, Liberation Day shock, global trade war, economic crisis